Tesla, MicroStrategy, Block Face Hit From Bitcoin

-비트코인과 같은 암호화페의 휘발성 자산 같은 것들을 회사의 자산으로 보유하고 운영하는 것은 어렵다고 하면, 비트코인이 크게 하락했지만, 요 근래 약간 반등을 했다는 이야기이기도 합니다. 그래도 high risk, high return 을 기대하는 뉴양스 입니다.

- 본 기사에서는 비트코인이 해당회사의 재무제표에 등록이 되있는 상태이고, 요 근래 변동성으로 주식이 크게 하락한 상태이다, 예로 테슬라의 주가는 30% 하락한 상태이고, MS와 Block은 절반까지 하락한 상태이다.

머스크가 $1.5B의 비트코인을 매수할때, "good thing" 이라며 광범위하게 적용 될 것이라고 했습니다만, 2분기에 약 75%를 매도 했다는 소식입니다. 그 사유는 중국의 lockdown으로 테슬라의 재무제표 건전성을 위한 것이라고 설명했네요.

그러나 전화통화에서 매도를 한 상태이지만, 앞으로 비트코인을 매수할 가능성이 여전히 존재하다고 했으며, 테슬라는 도지코인은 아직 그래도 보유하고 있다고 언급했다. 이 언급으로 비트코인이 2.2% 하락하고 있다고 언급하고 있네요.

투자자들은 아직 지켜보고 있다고 합니다. MS와 Block의 전략과 암호화폐의 시장에 대해서 말이죠.

현재 Block의 비트코인 보유현황에 대해 이야기 하지 않고 있고, 테슬라나 MS도 의견을 내진 않고 있습니다.

아직 메인 bitcoin holder 들은 큰 손실을 보고 있지만, holding 하고 있고, 테슬라만 손절한 상태라는 이야기 입니다.

그러나 테슬라도 다시 매수하기 위해 모니터링 중이라는 뉴양스의 의견을 내 놓은 상태입니다.

(Bloomberg) -- As if the environment weren’t tough enough for one-time stock market high-flyers Tesla Inc., MicroStrategy Inc. and Block Inc., the three companies took an estimated combined hit of $5 billion on their holdings of Bitcoin in the second quarter.

The decline in value reflects the 59% plunge in the cryptocurrency’s price in the period ending June 30. Bloomberg calculated the loss based on the companies’ previous disclosures about their Bitcoin stashes.

While those are paper losses only for MicroStrategy and Block until they sell, Tesla has locked in some of the drop: The carmaker unloaded the majority of its Bitcoin in the quarter, and an impairment hurt profitability, it said Wednesday.

The toll shows the danger that companies run when they decide to stash some of their corporate treasury -- normally held in cash or ultra-safe short-term Treasuries -- in volatile cryptocurrencies. While Bitcoin has rebounded a bit from its low last month under $18,000, there’s no guarantee it will ever get anywhere near its November high of almost $68,000.

“It’s very risky for companies to purchase Bitcoin, which is an extremely volatile asset, and puts the company’s cash at risk of severe losses,” said Jerry Klein, managing director at Treasury Partners, a New York firm that manages cash for corporations.

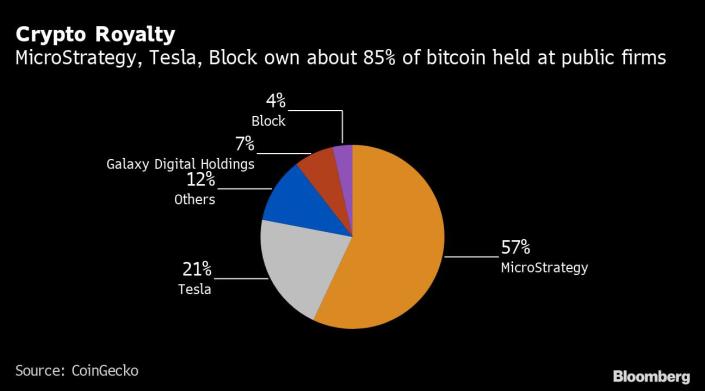

There are at least 27 public companies with Bitcoin on their balance sheet, according to CoinGecko. While most of them are cryptocurrency miners and financial service firms, more than 85% of the Bitcoins held at public companies were with software company MicroStrategy, carmaker Tesla and payments provider Block.

For investors, the holdings add a layer of risk to what are already volatile stocks. Their shares have been hit by surging inflation, rising interest rates and the prospect of a possible recession. Tesla’s stock is down 30% this year, while MicroStrategy and Block have each lost about half their value.

All three companies are led by big proponents of the cryptocurrency. MicroStrategy Chief Executive Officer Michael Saylor has made one of the boldest moves, with his company shelling out almost $4 billion to buy 129,699 Bitcoins. Based on the price move, the tokens dropped in value by $3.4 billion in the second quarter.

The software firm became the first public company to invest the lion’s share of its treasury in Bitcoin in 2020 after Saylor questioned the conventional strategy of investing in short-term US government securities when yields tumbled, adding that inflation would make cash worthless.

Elon Musk’s Tesla bought $1.5 billion of the token early last year and quickly sold some of that stash at a gain. Musk said around that time that the cryptocurrency is a “good thing” and on the verge of getting “broad acceptance by conventional finance people.”

It sold 75% of its remaining holdings in the second quarter because it was unsure how long Covid lockdowns in China would last, so it wanted to have extra cash on its balance sheet, Musk said on an earnings call Wednesday. The company operates a factory in Shanghai.

“We are certainly open to increasing our Bitcoin holdings in future,” he said on the call. “So this should not be taken as some verdict on Bitcoin.” Tesla hasn’t sold any of its holdings of another token, Dogecoin, he said.

Bitcoin fell 2.2% to $22,725 as of 9:35 a.m. in New York.

Block, run by Bitcoin enthusiast and Twitter co-founder Jack Dorsey, owned $366 million worth of that coin as of March 31, according to a company statement.

Investors will be watching earnings from MicroStrategy and Block, on Aug. 2 and Aug. 4, respectively, to see how big a writedown each takes on the holdings.

Marking Tesla’s estimated holdings and Square’s stake at the June 30 Bitcoin market price of about $18,731 puts the combined paper losses for the three companies at about $5 billion, according to Bloomberg calculations. About 70% of that comes from MicroStrategy.

A representative for Block declined to comment on the company’s Bitcoin holdings, while Tesla and MicroStrategy didn’t respond to requests for comment.

“I think the companies that hold Bitcoin will try to hold onto it now that it has fallen so far,” said Matt Maley, chief market strategist at Miller Tabak + Co. “However, they might be forced to sell it due to margin calls if it sees another meaningful down leg.”

Read more: MicroStrategy CEO Saylor Says No Margin Call on Bitcoin Loan

Tech Chart of the Day

Tesla, the world’s most valuable automaker and the only profitable US EV firm, is outperforming peers this year as investors move away from unprofitable growth companies. Tesla rose as much as 5% on Thursday after it reported second-quarter earnings that beat Wall Street estimates. Meanwhile, Nikola Corp. and Lucid Group Inc. have plunged about 40% this year and Rivian’s stock has lost more than two-thirds of its value.

Top Tech Stories

- China fined Didi Global Inc. more than 8 billion yuan ($1.2 billion), wrapping up a year-long probe into the ride-hailing giant that’s come to symbolize Beijing’s bruising campaign to rein in its powerful internet industry.

- Apple Inc.’s pivot to a subscription-like model creates a clear path to a market capitalization of more than $3 trillion, according to Morgan Stanley.

- Tesla Inc. Chief Executive Officer Elon Musk said the electric-vehicle manufacturer has been through “supply chain hell,” but sees commodities prices trending lower and signaled optimism the company can achieve record volume over the rest of the year.

- Intel Corp. spent a record $1.75 million on federal lobbying over the past three months as the semiconductor industry fought to secure billions of dollars in grants and subsidies from Congress.

- Microsoft Corp. said Wednesday it was eliminating many job openings. Google is pausing hiring for the next two weeks, while Lyft is shutting down a division and trimming jobs.

- Contentsquare, the French provider of web analytics, is raising $600 million in a round of funding led by Sixth Street, valuing the startup at $5.6 billion, confirming reporting by Bloomberg this month.

- NetEase Inc. is planning to debut the Diablo Immortal mobile game in China on July 25 -- a month after the highly anticipated title was originally scheduled to launch in the world’s biggest gaming market.

- Semiconductor Manufacturing International Corp. has likely advanced its production technology by two generations, defying US sanctions intended to halt the rise of China’s largest chipmaker.

- SAP SE cut its 2022 operating profit forecast amid a reduced contribution from software licenses revenue and fallout from the war in Ukraine.

출처 : ©2022 Bloomberg L.P.

'- 코인 투자 > - 코인 뉴스' 카테고리의 다른 글

| [22/8/13] 코인 관련 동향 및 뉴스 정리 (0) | 2022.08.13 |

|---|---|

| 7월 26일 하원 금융서비스 위원회 Stablecoins규제 협의 뉴스 (0) | 2022.07.26 |

| [22/6/12] 이더리움 현 상황 뉴스 및 분석 (0) | 2022.06.12 |

| [22/6/4] 가상화폐 전망 및 뉴스 (0) | 2022.06.04 |

| [22/5/14] 테라 생태계 부흥 계획 정리 (0) | 2022.05.14 |